When you take a pill for high blood pressure, diabetes, or an infection, there’s a good chance the active ingredient inside came from a factory in China. Around 80% of the world’s active pharmaceutical ingredients (APIs) - the core chemical components that make drugs work - are made in China. That’s not a small number. It’s the backbone of generic medicine globally. But behind the low prices and massive output, serious quality concerns are growing. And they’re not just theoretical. They’re showing up in recalls, failed inspections, and doctors’ offices.

How China Became the World’s Drug Factory

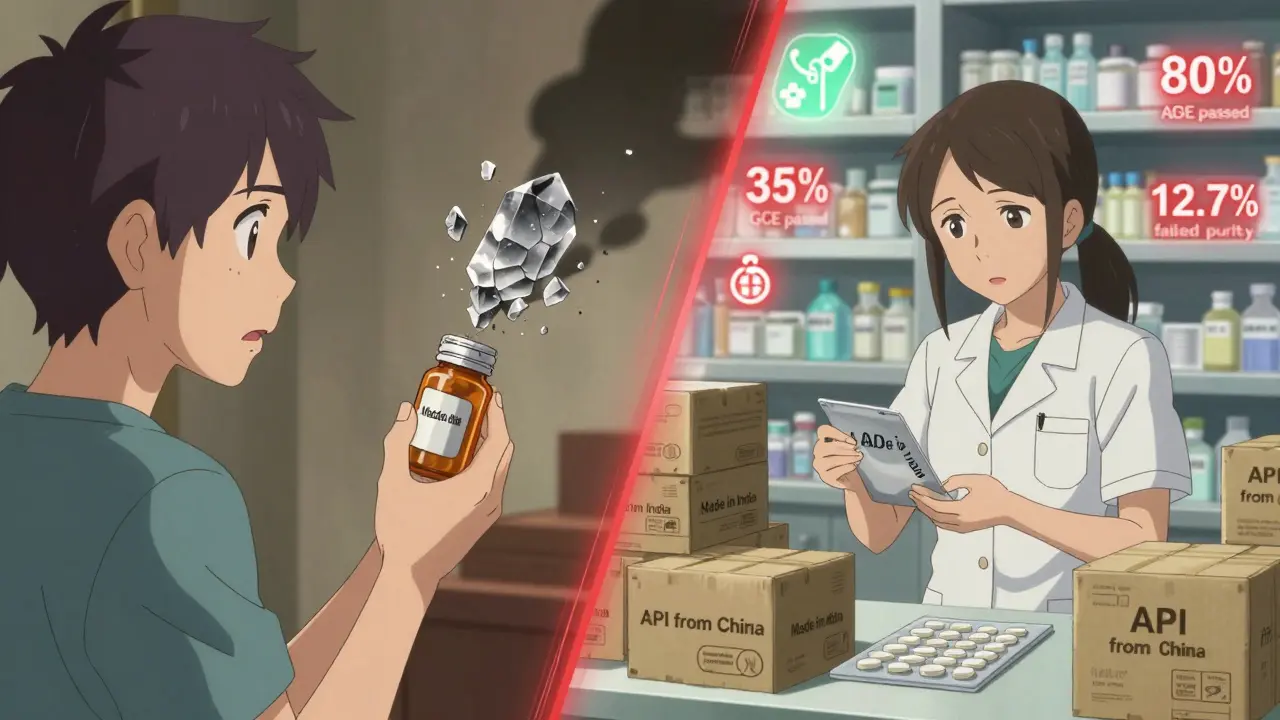

China didn’t become the top API producer overnight. After joining the World Trade Organization in 2001, the government poured billions into building chemical plants, training workers, and cutting red tape. By 2015, it had become clear: if you wanted cheap drugs, you went to China. The 2016 Generic Consistency Evaluation (GCE) program was supposed to fix quality. It required Chinese generic drugs to prove they worked just like the brand-name versions. But as of 2024, only 35% of approved generics have passed this test. Most factories still operate like they did 15 years ago - using outdated batch processing instead of modern continuous manufacturing. That’s a big deal. Continuous manufacturing reduces errors, improves consistency, and catches problems faster. The U.S. and Europe use it in 35% of their facilities. China? Less than 20%.Why Quality Keeps Failing

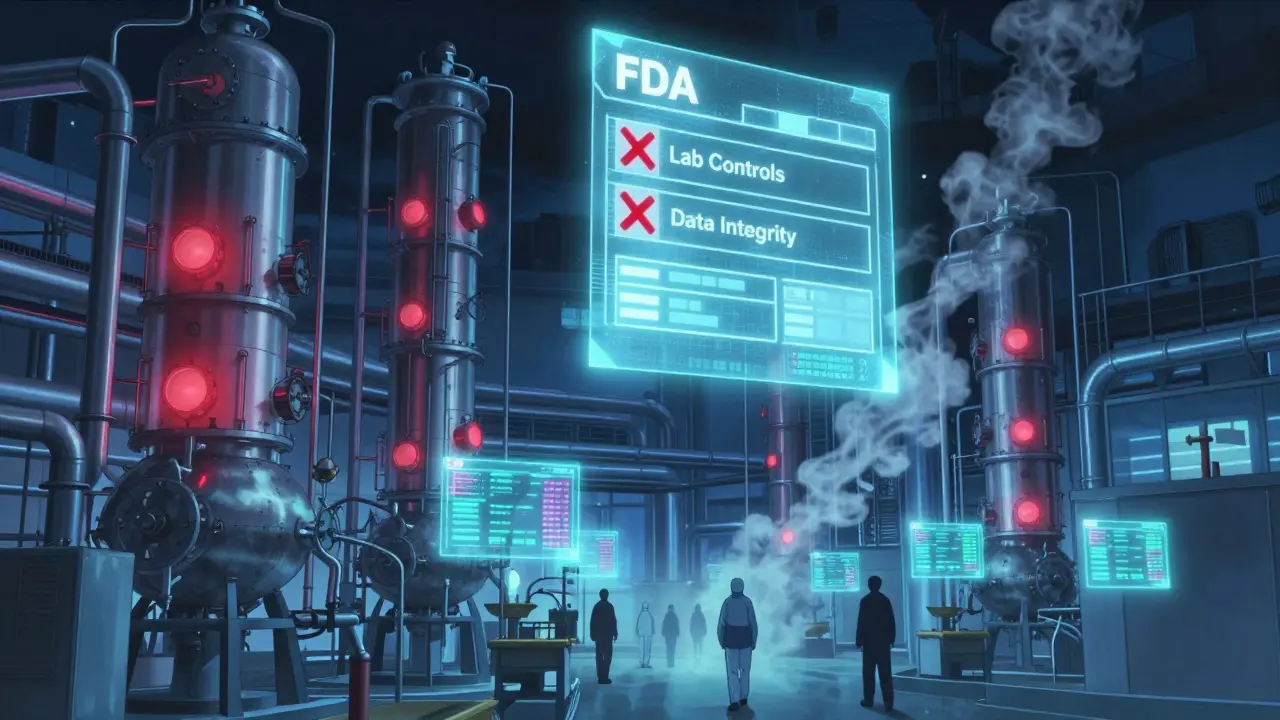

The U.S. Food and Drug Administration (FDA) inspects Chinese drug factories less than once every five years on average - compared to every 18 months for U.S. plants. That’s not because China is safe. It’s because access is limited. In 2022 and 2023, FDA warning letters to Chinese manufacturers cited the same problems over and over:- 78% had inadequate lab controls - meaning they didn’t properly test raw materials or finished products

- 65% didn’t validate their manufacturing processes - so no one knew if the same batch would turn out the same way next time

- 52% had data integrity issues - records were altered, deleted, or never created in the first place

The Cost Advantage Isn’t Just About Price

Chinese APIs cost between $50 and $150 per kilogram. The same API made in Europe or the U.S. costs $200 to $400. That’s why 88% of all API facilities serving the U.S. market are overseas - and nearly 28% of them are in China. But here’s the catch: the cheapest option isn’t always the cheapest in the long run. A 2024 Gartner survey of 150 pharmaceutical companies showed Chinese suppliers scored 3.2 out of 5 for quality consistency. European suppliers scored 4.1. But Chinese suppliers scored 4.7 out of 5 for price. That’s the trade-off. Companies save millions upfront - but then they pay more in retesting, recalls, and lost trust. One U.S. generic drug maker told a reporter they saved $4.2 million a year switching to Chinese metformin API - but had to retest 37% of batches, compared to just 8% for Indian-sourced API. That’s not efficiency. That’s risk.

China Makes the Ingredients, India Makes the Pills

China doesn’t just make APIs - it dominates the early, dangerous steps of chemical synthesis. Things like fluorination, handling toxic solvents, and producing intermediates. These are the parts Western companies stopped doing because they’re expensive and hazardous. China took them over. But here’s the irony: while China produces 80% of the world’s APIs, it only exports 5-7% of finished generic pills. That’s because Indian companies buy those APIs and turn them into tablets and capsules. India controls 20% of the global generic drug market - and gets 65% of its APIs from China. So if China’s supply chain breaks, India’s drug production breaks too. And so does the U.S. supply. The Atlantic Council called this a “single point of failure” for 90% of essential medicines. That’s not an exaggeration. If a Chinese factory shuts down because of pollution violations or an inspection failure, thousands of American prescriptions go unfilled.What’s Changing - and What’s Not

China says it’s fixing things. The National Medical Products Administration (NMPA) claims it’s shut down 80% of non-compliant factories since 2015. It’s pushing companies to adopt ICH Q7 standards. It’s offering faster approvals for domestic drugs. And it’s spending $22 billion on its “Pharma 2035” plan to upgrade technology. But here’s what’s missing: transparency. The FDA still can’t inspect most Chinese plants on its own schedule. Data from Chinese labs is often not auditable. And the GCE program? It’s slow. Only 35% of generics have passed. That means 65% are still on the market without proof they work like the original. Meanwhile, the U.S. and EU are moving fast to reduce dependence. The U.S. CHIPS and Science Act gave $500 million to build domestic API plants. The EU wants to cut Chinese API imports from 80% to 40% by 2030. Vietnam, Mexico, and India are stepping in to fill the gap.

What This Means for Patients

You might think, “If the drug works, why does it matter where it’s made?” But it matters because consistency is safety. A pill that works one month and fails the next isn’t just a quality issue - it’s a health risk. Imagine taking your blood pressure medicine and your numbers jump because the API was under-dosed. Or your antibiotic doesn’t kill the infection because it’s contaminated. These aren’t hypotheticals. They’ve happened. And they’ll keep happening until China’s factories stop cutting corners. The good news? Some Chinese companies are getting better. Pfizer spent three years and $22 million upgrading its joint venture with Zhejiang Huahai to meet FDA standards. It worked. But that’s the exception - not the rule.The Future of Generic Drugs

China isn’t going away. It’s too big, too cheap, and too integrated into the global supply chain. But its dominance is weakening. By 2030, experts predict China’s share of the API market will drop from 78% to 65%. Why? Because the cost of ignoring quality is rising. Recalls cost millions. Lost trust costs more. And governments are no longer willing to gamble with public health. The real question isn’t whether China can make cheap drugs. It’s whether it can make safe ones - consistently, reliably, and transparently. Until then, patients and regulators will keep asking: who’s really watching the factory?Are Chinese generic drugs safe to take?

Many are - but not all. The FDA approves specific batches from specific factories, and those that pass inspection are safe. But the system relies on inspections that happen rarely, and many factories still fail quality controls. If your drug is FDA-approved and sourced from a verified supplier, it’s likely safe. But there’s no public way to know if your specific pill came from a compliant factory. That’s the gap.

Why do U.S. companies keep using Chinese APIs if the quality is poor?

Because they have no choice - yet. Chinese APIs are 30-40% cheaper than those made in the U.S. or Europe. For generic drug makers operating on thin margins, that savings is the difference between staying in business and shutting down. Many companies try to balance cost with risk: they use Chinese APIs for low-risk drugs (like antacids) and source higher-risk ones (like blood thinners) from more reliable suppliers. But switching suppliers takes years and millions of dollars in retesting and reformulation.

Can I tell if my medicine contains Chinese-sourced ingredients?

No, you can’t. U.S. law doesn’t require drug labels to list where the active ingredient was made. Only the final manufacturer is listed - which could be in India, the U.S., or anywhere else. Even pharmacists usually don’t know the origin of the API. The only way to find out is to contact the manufacturer directly - and even then, they may not disclose it.

Is India a safer alternative to China for generic drugs?

India has better track records for finished drug quality and regulatory compliance, but it still relies on China for most of its APIs. So while Indian-made pills are often more reliable, the raw material may still come from China. India’s own factories have had FDA warnings too - but at a lower rate than China. The real solution isn’t switching from China to India - it’s building independent, high-quality manufacturing in multiple countries.

What’s being done to fix the problem?

Several things. The U.S. and EU are funding domestic API production. The FDA is pushing for more inspections in China and better data sharing. China’s own regulators are upgrading standards and requiring electronic records. But progress is slow. Real change will only happen when the cost of cutting corners exceeds the cost of compliance - and that’s still years away.

Should I avoid generic drugs made with Chinese ingredients?

Not necessarily. Many life-saving generic drugs rely on Chinese APIs, and stopping their use could cause shortages. The key is to trust FDA-approved products - not the country of origin. If your doctor or pharmacist recommends a generic, it’s because it’s been tested and approved. But stay informed. If a drug you rely on is recalled, ask where the API came from. That’s the first step toward demanding better accountability.

This is insane. I take metformin every day and have zero idea if my pills were made in a factory where someone deleted lab logs. How is this even legal? We’re gambling with people’s lives because Big Pharma wants to save a few bucks. Someone needs to burn this whole system down.

Bro, I get it - China makes the spice, India makes the curry. But you ever think about how many Indian doctors rely on Chinese APIs too? 😔 It’s not about blame, it’s about building. We need more labs in Vietnam, Mexico, even Brazil. Not just replacing one giant with another. 🌍💊

It is rather disconcerting to observe that the regulatory infrastructure governing pharmaceutical manufacturing in the People’s Republic of China remains fundamentally inadequate when juxtaposed against the rigorous standards mandated by the FDA and EMA. The systemic deficiencies in data integrity, process validation, and lab controls represent not merely a commercial risk, but a profound breach of the social contract between the medical establishment and the public.

I just want to feel safe when I take my pills. I don’t care where they’re made - I care that they work the same every time. My grandma takes blood pressure meds. She doesn’t know what an API is. She just needs to live.

Here’s the real issue: no one’s tracking the API origin. You can’t tell if your drug came from a compliant factory. That’s not transparency - it’s negligence. Demand labeling. Contact your reps. This isn’t a supply chain problem. It’s a democracy problem.

Okay so let me get this straight - we outsource the most critical part of our medicine to a country that lies about its inspections, hides data, and has zero accountability… and we’re surprised when people die? 😭 I mean, I get the cost savings, but we’re literally letting people die to save $4.2 million a year? That’s not capitalism - that’s a horror movie. And now the FDA can’t even go in to check? What is this, North Korea with pills? I’m not even mad, I’m just… disappointed. Like, we used to be better than this.

So China makes 80% of the world’s medicine. The U.S. spends $500 million to build one new plant. And we’re supposed to be impressed? 😏 Meanwhile, the FDA inspects Chinese factories less than once every five years. That’s like letting your kid drive the car… once every five years… and hoping they don’t crash. The real question isn’t whether China can make cheap drugs - it’s whether we’re still adults who think this is acceptable. Spoiler: we’re not.

Look, I’ve worked in pharma logistics. I’ve seen the paperwork. Half the time, the ‘approved’ batch number on the box doesn’t even match the lab report. And the worst part? The people who know this are the ones who make the most money off it. I’m not saying avoid generics - I’m saying don’t trust the system. If your drug gets recalled, you’ll hear about it on the news. But by then? Your blood pressure is already in the danger zone. And guess what? Your pharmacist won’t even know why. That’s not a glitch. That’s the design.