When you take a pill for high blood pressure or antibiotics, chances are it was made in China or India. These two countries supply over 80% of the world’s active pharmaceutical ingredients (APIs) and most generic drugs. But behind the low prices and fast delivery lies a complex reality: China and India manufacturing carry very different risks - and the FDA watches them in very different ways.

Why the FDA Cares So Much

The FDA doesn’t just inspect factories for fun. Every batch of medicine that enters the U.S. must meet strict standards under 21 CFR Part 211. A single contaminated batch can cause deaths. In 2008, heparin from China was tainted with a toxic substance, leading to over 100 deaths. That’s why the FDA sends inspectors to manufacturing sites - and why they’re spending more time in China than ever before. In 2023, 37% of Chinese pharmaceutical facilities faced FDA import alerts - warnings that a product might be unsafe or mislabeled. For Indian facilities, that number was just 18%. That’s not a coincidence. It’s the result of years of regulatory evolution, cultural alignment, and investment in quality systems.India’s Edge: Compliance Over Scale

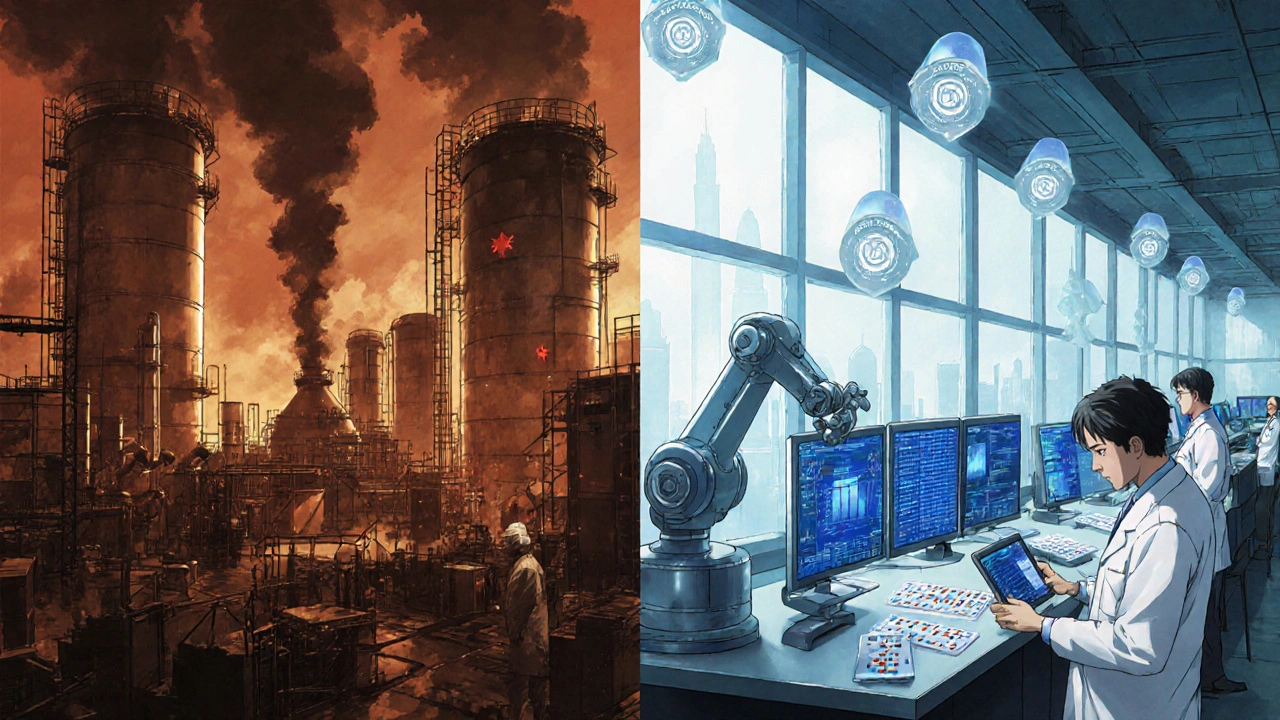

India has over 100 FDA-approved manufacturing plants. China has 28. That’s not a typo. India leads in certified capacity by a wide margin. Why? Because Indian pharma companies learned early that compliance isn’t optional - it’s the price of entry into Western markets. Companies like Dr. Reddy’s, Sun Pharma, and Cipla built their businesses on supplying generic drugs to the U.S. and Europe. To do that, they had to pass FDA inspections - repeatedly. Many invested in digital quality systems that track every step of production, from raw materials to packaging. Bain & Company found that over 50% of Asia-Pacific contract research organizations (CROs) are based in India, not China. The result? Fewer Form 483 observations - the FDA’s official list of violations - during inspections. Indian plants see about 30% fewer issues than Chinese ones. That means fewer delays, fewer recalls, and more trust from buyers.China’s Strength: Volume and Cost

China dominates the API market. It produces an estimated 80% of the world’s generic drug ingredients. That’s because China built massive, vertically integrated factories that can churn out tons of chemicals at a fraction of the cost. But cost doesn’t always mean quality. Smaller Chinese suppliers often cut corners to stay competitive. The FDA has caught multiple facilities falsifying data, using unapproved raw materials, or skipping stability tests. These aren’t rumors - they’re documented in public inspection reports. China’s government has pushed hard to upgrade standards. Factories now claim ISO, CE, and RoHS certifications. But certification doesn’t always mean consistent quality. A factory might pass an inspection one month and fail the next. The system is less predictable. And with rising labor costs and tighter U.S. scrutiny, China’s cost advantage is shrinking.

The Hidden Weakness in India’s Model

Here’s the uncomfortable truth: India depends on China for its own medicines. In FY2024, India imported 72% of its bulk drug ingredients from China - up from 66% just two years earlier. That means even if your drug was made in India, the key chemical inside likely came from China. This creates a single point of failure. If China restricts exports - for political, economic, or health reasons - India’s entire supply chain could stall. U.S. pharmaceutical companies are now scrambling to fix this. One sourcing executive told Bain & Company: “We’re trying to diversify, but we’re stuck. We can’t make APIs without China.” India’s “Make in India” program is trying to fix this. The government has allocated nearly $3 billion in incentives to build domestic API production. But it’s a long game. Building a plant that meets FDA standards takes years. And right now, China still has the scale, the infrastructure, and the chemical expertise.What the ‘China+1’ Strategy Really Means

Since 2020, many U.S. drugmakers have adopted a “China+1” strategy: keep some production in China, but move at least one major line to India. Why? Because India offers something China can’t: reliability. When you’re making medicine for millions of patients, you don’t want to gamble on inconsistent quality. Indian factories have a track record. They speak English. Their regulatory teams understand FDA expectations. And their workforce is trained on U.S. standards. This isn’t about patriotism. It’s about risk management. A single recall can cost a company hundreds of millions - and destroy brand trust. India reduces that risk. But it’s not perfect. Setting up in India takes 6 to 9 months just to get compliant. In China, you might get started in 3 to 6 months - but then you’ll likely need to spend another 6 months fixing problems the FDA finds later.

The Future: Biologics and Beyond

The next frontier isn’t just generic pills. It’s biologics - complex drugs made from living cells, like insulin or cancer treatments. These are harder to make, harder to copy, and far more profitable. China is leading here. Its biopharmaceutical market is growing at 19.3% per year. India’s is growing faster - 22% - but from a much smaller base. India still focuses on cheap generics. China is moving up the value chain. If India wants to stay ahead long-term, it needs to stop being just a copycat. It needs to invest in innovation. Right now, most of India’s government incentives go to generic production. Experts say that’s a mistake. “We need to allocate more funding to biosimilars, cell therapies, and gene therapies,” says a Bain & Company analyst. “Otherwise, we’ll just be replacing one dependency - for APIs - with another - for advanced drugs.”What This Means for You

You might not care where your medicine comes from. But you should. If your drug is recalled, it’s your health on the line. If your prescription gets delayed, it’s your life that’s disrupted. The FDA’s inspections are your safety net. But they’re not perfect. They inspect only a fraction of factories each year. That means the system relies heavily on manufacturers doing the right thing - even when no one’s watching. India’s model is more trustworthy. China’s is more efficient. But both are part of the same global supply chain. And right now, the world is betting on India to be the safer, more reliable partner. The lesson? Don’t assume all generics are equal. Ask your pharmacist: “Is this made in India or China?” It’s not a question you should feel awkward asking. It’s a question that could save your life.Why does the FDA inspect Indian factories less than Chinese ones?

The FDA inspects Indian facilities less often because they have a stronger track record of compliance. Between 2020 and 2023, Indian plants received 30% fewer Form 483 observations - official notices of violations - than Chinese ones. Indian manufacturers have invested heavily in digital quality systems, staff training, and adherence to FDA standards since the 1990s, making them more predictable. China’s factories, while improving, still show higher rates of data falsification, poor sanitation, and unapproved processes, leading to more frequent inspections and import alerts.

Is medicine made in India safer than medicine made in China?

On average, yes - but it’s not guaranteed. Indian-made drugs are more likely to meet FDA standards because manufacturers have spent decades tailoring their processes to Western regulations. Over 100 Indian plants are FDA-approved, compared to 28 in China. However, quality varies by company, not just country. A small, poorly managed factory in India can still produce unsafe drugs. The key difference is consistency: Indian firms are more likely to maintain quality over time, while Chinese facilities often show wide swings between inspections.

Why does India rely so heavily on China for drug ingredients?

India has focused on packaging and formulating drugs rather than producing the raw chemicals (APIs) themselves. China built massive, low-cost chemical plants decades ago and now controls nearly 80% of the global API market. India’s domestic API industry is underdeveloped, and shifting production there requires billions in investment and years of regulatory alignment. Even with India’s “Make in India” program, it will take over a decade to reduce dependence. For now, 72% of India’s APIs come from China - making the entire supply chain vulnerable to disruptions.

What is the ‘China+1’ strategy in pharma manufacturing?

The ‘China+1’ strategy means pharmaceutical companies keep some manufacturing in China but move at least one critical production line to another country - usually India - to reduce risk. This isn’t about abandoning China; it’s about avoiding a single point of failure. If a political conflict, natural disaster, or regulatory crackdown shuts down a Chinese factory, having a backup in India ensures medicine continues to flow. Companies choose India because of its proven compliance, English-speaking workforce, and familiarity with FDA rules.

Can I trust generic drugs from India or China?

Yes - if they’re made by reputable companies and approved by the FDA. Generic drugs, whether from India or China, must meet the same standards as brand-name drugs to be sold in the U.S. The FDA requires them to have the same active ingredient, strength, dosage form, and bioavailability. But trust comes from transparency. Look for brands with a history of FDA approvals. Avoid unknown suppliers or online pharmacies that don’t list the manufacturer. If a drug is FDA-approved, it’s safe - regardless of where it was made.

Are U.S. drug companies moving away from China entirely?

No - but they’re reducing reliance. China still produces the cheapest and most abundant APIs. Many U.S. companies still source basic ingredients from China because switching is expensive and slow. However, for finished drugs - especially those used in hospitals or for chronic conditions - companies are shifting production to India. The goal isn’t to eliminate China, but to diversify. By 2030, China’s share of outsourced pharma manufacturing is expected to drop from 25% to around 15%, while India’s share will rise.

India thinks it's better because it speaks English? LOL. China builds everything. China feeds the world. India just packages it and calls it their own. You think FDA inspections mean anything? They inspect what they're told to inspect. The real story is China controls the supply and India just plays nice to get the crumbs. This whole article is Western propaganda to justify their fear of China. We don't need your inspections. We have our own standards. Your pills are overpriced because you're scared of real manufacturing.

Let’s cut through the jargon: India’s compliance is a performance. China’s scale is reality. The FDA’s 37% import alert rate for China? That’s not a failure-it’s a function of volume. When you produce 80% of the world’s APIs, you’re going to have outliers. India’s 18% isn’t superiority-it’s low volume + selective outsourcing. And let’s not pretend Indian factories don’t cut corners. They just outsource the risk to China. The real issue? Global pharma is a cartel that rewards compliance theater over actual innovation.

They don’t want you to know this-but the FDA doesn’t inspect 95% of facilities. It’s a theater. The inspections you see? They’re cherry-picked. The ones that fail? They get ‘voluntary’ recalls and re-inspect after a year. Meanwhile, the Chinese factories that falsify data? They’re owned by state-linked conglomerates that have backdoor deals with U.S. distributors. And India? They’re the middlemen in a global Ponzi scheme. You think your blood pressure med is safe? It’s a Russian roulette chip stamped with ‘FDA Approved’-a bureaucratic stamp of ignorance. The real danger isn’t China or India-it’s the illusion of oversight.

As someone from India, I see both sides. Yes, we have more FDA-approved plants. But we’re still dependent on China for APIs. It’s embarrassing, but true. Our government promised ‘Make in India’ for a decade, but the infrastructure, chemical expertise, and economies of scale? Still Chinese. We’re good at formulation, packaging, and compliance-but not at synthesis. It’s not about patriotism. It’s about physics and chemistry. You can’t fake a kilo of active ingredient. China built that. We’re learning to build it too. Slowly.

Let’s be brutally honest: India’s ‘compliance advantage’ is a myth built on selective reporting. The FDA doesn’t inspect every batch. They inspect every *document*. Indian firms have perfected the art of paper compliance-digital logs, fake batch records, pre-approved SOPs. Chinese factories falsify data. Indian ones falsify *evidence*. Both are dangerous. The only difference? India’s lawyers are better. And yes, they speak English. That’s not quality. That’s marketing.

I’ve worked in pharma supply chains for 18 years. I’ve sat in FDA inspection rooms in both Shenzhen and Hyderabad. The truth? It’s not about country-it’s about company. A small Indian contract manufacturer with 3 employees and no QA system is just as risky as a shady Chinese plant. But big Indian firms? They’ve been through the wringer since the 90s. They know what FDA wants. They train staff like soldiers. Chinese factories? They’re pressured by quotas, not quality. The real story here isn’t nationalism-it’s institutional memory. India has decades of hard-won experience. China has capital and speed. But experience beats speed when your life depends on it.

India = ✅

China = 🚫

My pill = 🤷♂️

My blood pressure = 😬

Look, I get it. We all want our meds to be safe. But this ‘China bad, India good’ thing is getting old. My grandma’s blood pressure med? Made in India. My kid’s antibiotic? Made in China. Both worked. Both were FDA-approved. The real issue? We treat medicine like a commodity. We don’t care who makes it-as long as it’s cheap and on the shelf. Maybe we should care more. But blaming countries? That’s just distraction. The system’s broken. Not the factories.

Wait-so if India’s so compliant, why does it import 72% of its APIs from China? That’s not a supply chain-that’s a hostage situation. And the FDA’s inspection rates? They’re not measuring quality-they’re measuring exposure. More inspections in China because there’s more to inspect. More violations because there’s more volume. But here’s the deeper truth: the entire global pharma system is a pyramid scheme built on cost arbitrage. The U.S. outsources production because it’s cheaper. Then we panic when it breaks. We don’t invest in domestic manufacturing because we’re addicted to low prices. India is not the hero. It’s just the next stop on the conveyor belt. And China? It’s the engine. The FDA is just the janitor cleaning up the mess after the party.

It is morally indefensible that the United States relies upon foreign nations for life-saving pharmaceuticals. This is not a matter of economics-it is a matter of national security. The fact that our citizens are dependent upon regimes with questionable ethics for essential medicine is a failure of leadership, of vision, and of character. We must rebuild domestic production. We must prioritize sovereignty over savings. Anything less is a betrayal of the American people.

So... we're all just gambling with our meds? 😅

And the FDA's like, 'eh, we'll check one this month.'

Meanwhile, my pills are made in a factory I can't even Google.

Thanks, capitalism.

China+1? More like China+1 lie. The whole thing is a scam. India's 'compliance' is just better PR. The FDA is a puppet of Big Pharma. The real reason they favor India? Because Indian companies pay them more in consulting fees. And China? They're the ones actually making the stuff. The rest is theater. And don't even get me started on the biologics-India's '22% growth' is from a base of nothing. China's already building the future. We're just arguing over who gets to sell the labels.

China is weaponizing medicine. This isn’t about quality-it’s about control. They’re not just making pills-they’re making leverage. Every time we buy Chinese APIs, we’re funding their military, their surveillance state, their expansion. India? They’re still a democracy. They answer to their people, not a party. If you’re buying a drug made in China, you’re not just taking medicine-you’re funding tyranny. This isn’t economics. This is treason.

My dad’s on a drug made in India. My sister’s on one made in China. Both work. Both cost less than my coffee.

Maybe the real question isn’t where it’s made-but whether we’re willing to pay more for peace of mind?

Because right now, we’re choosing cheap over careful.

And I’m not sure that’s fair to anyone.