How much do you really save when you use a prescription discount card or coupon? It sounds simple: show a code at the pharmacy, pay less. But the truth is messier. Some people save hundreds. Others pay almost the same as they would with insurance. And in some cases, using a coupon might actually cost you more in the long run.

What These Programs Actually Do

Prescription discount programs come in three main flavors. First, there are manufacturer coupons - those you get from drug companies for brand-name pills. Then there are third-party discount cards like GoodRx, Blink Health, and SingleCare. These don’t come from the drug maker; they’re middlemen who negotiate lower cash prices with pharmacies. Finally, there are Prescription Assistance Programs (PAPs), usually run by nonprofits or clinics, which give free medicine to people who qualify based on income.They all promise one thing: lower out-of-pocket costs. And for generics, they often deliver. A 2022 study found that GoodRx and similar cards cut the price of common generic drugs by an average of 65%. For example, a 90-day supply of metformin - a diabetes pill - dropped from $52.80 to just $18.60 using a discount card. That’s real savings.

But here’s the catch: brand-name drugs? Not so much. The same study showed that for a four-drug heart failure regimen, the discount card only saved $88.04 out of $1,300.50. That’s less than 7%. If you’re on a high-cost brand-name drug, the coupon might look good on paper, but the actual savings are tiny.

When Coupons Backfire

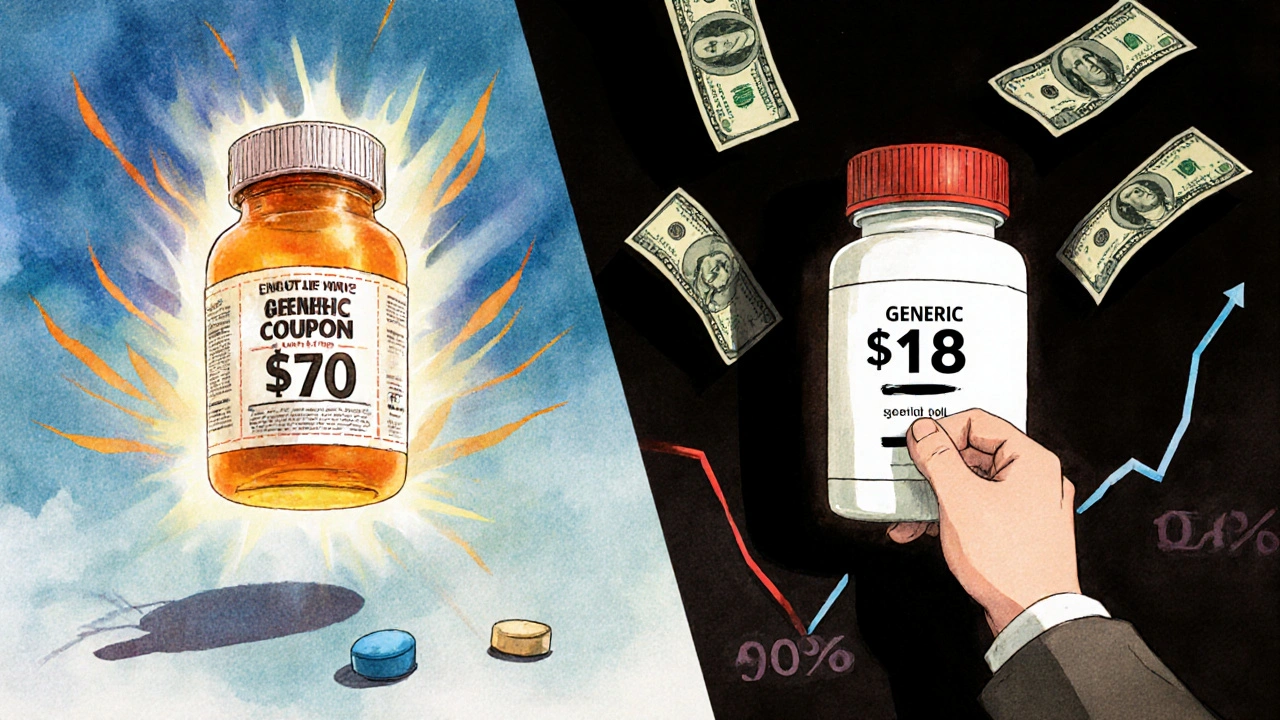

Manufacturer coupons are the trickiest. They’re designed to make brand-name drugs feel affordable - even when they’re not. The drug company gives you a $50 coupon, so you pay $20 instead of $70. Sounds great, right?But here’s what’s happening behind the scenes: the list price of that drug hasn’t changed. The insurance company still pays the full $70. The pharmacy gets paid the full $70. The coupon just shifts the cost from you to the insurer - and ultimately, to everyone else paying premiums.

Worse, research shows these coupons push people away from cheaper generics. One study found that when a coupon was offered for a brand-name drug, generic sales dropped by more than 60%. That’s not saving money - it’s inflating costs across the whole system. The Congressional Budget Office estimates manufacturer coupons could raise Medicare Part D spending by $2.7 billion a year.

And if you’re on Medicare Part D? You can’t even use most manufacturer coupons. The program blocks them unless you get special permission. So you might spend 20 minutes signing up for a coupon - only to find out it won’t work at your pharmacy.

Third-Party Cards: GoodRx and Others

GoodRx dominates the market, controlling about 58% of third-party discount card usage. It’s popular because it’s easy. Open the app, type in your drug, and see prices at nearby pharmacies. You can even compare prices across 70,000 locations.For people without insurance, or with high-deductible plans, these cards are lifesavers. A Blue Cross Blue Shield analysis found that 54% of members who gave up on a prescription because it was too expensive ended up using a discount card - saving an average of $18.75 per fill.

But it’s not perfect. Users complain about inconsistent pricing. One pharmacy might list a drug at $12. Another, just a mile away, says $28. Why? Because pharmacies set their own cash prices, and discount cards negotiate different deals with each one. Pharmacists sometimes don’t know how to process the codes. You show up with your GoodRx coupon, and the pharmacist says, “We don’t accept that.” You have to call ahead, or try another location.

And if you’re on Medicare? You need to be careful. Sometimes, the cash price with a discount card is cheaper than your Medicare copay. Other times, it’s not. The problem? Medicare doesn’t count discount card payments toward your deductible or out-of-pocket maximum. So even if you pay less now, you might end up paying more later.

Who Benefits the Most?

The biggest winners? People without insurance, or those with high-deductible plans. For them, a discount card can cut a $150 prescription down to $30. That’s the difference between taking your meds and skipping them.Seniors on Medicare Part D are another big group. The AARP found that more than half of Medicare users could save 20% or more by switching from their plan’s price to a discount card - especially for generics. Nearly half saved more than $5 per prescription. That adds up fast if you’re on five or six meds.

But if you have good insurance with low copays? You might not save anything. In fact, you might be worse off. One study found that coupon users paid more out-of-pocket than those who didn’t use coupons - because their insurance copay was already lower than the discounted cash price.

And if you’re on a high-cost brand-name drug? Don’t expect miracles. The savings are minimal. You’re better off asking your doctor about generics, or applying for a Prescription Assistance Program.

Prescription Assistance Programs: Free Meds for Those Who Qualify

PAPs are the quiet heroes. They’re run by nonprofits, clinics, or drug companies, and they give free medication to people with low income and no insurance. No coupons. No apps. Just paperwork.A Tennessee free clinic gave out 23 different medications to 61 patients over 13 months. Total savings? $222,563. That’s $3,649 per person. Compare that to GoodRx’s average $18.75 savings - this is a different level of help.

But the catch? You have to qualify. Income limits, paperwork, doctor letters, proof of residency. It’s not easy. One patient spent 16 hours total just filling out forms and getting documents signed. But for those who make it through? It’s life-changing.

How to Use These Programs Right

Here’s how to actually save money - not just feel like you’re saving:- Always check your insurance copay first. Write it down.

- Then check GoodRx or another discount card. Compare the cash price.

- If the discount card is cheaper, use it. If your insurance is lower, stick with it.

- For brand-name drugs, ask your doctor: “Is there a generic?” or “Can I switch to a cheaper alternative?”

- If you’re on Medicare, never assume a coupon works. Call your pharmacy first.

- If you’re uninsured or low-income, apply for a PAP. Go to NeedyMeds.org - it’s free and lists hundreds of programs.

Don’t just grab the first coupon you see. Spend five minutes comparing. That’s all it takes.

The Bigger Picture

These programs exist because drug prices are broken. They’re not a fix - they’re a bandage. The 2024 Inflation Reduction Act is starting to change that. By 2025, Medicare beneficiaries will pay no more than $2,000 a year for prescriptions. That’s huge.Meanwhile, the Federal Trade Commission is investigating whether manufacturer coupons are anti-competitive. Preliminary findings suggest they drive up overall spending by $4.7 billion a year.

So what’s next? Experts say the future lies in programs that work with insurance, not against it. Imagine an app that checks your insurance, your discount card options, and your eligibility for free meds - all in one place. Some pharmacy chains are already piloting AI tools that do exactly that.

For now, you have to be your own advocate. Know your options. Compare prices. Ask questions. And don’t let a coupon trick you into thinking you’re saving money - when you’re really just paying someone else’s bill.

Do prescription discount cards work better than insurance?

Sometimes. If your insurance has a high deductible or high copay, a discount card like GoodRx can be cheaper - especially for generic drugs. But if your insurance already gives you a low copay (like $5 or $10), the discount card won’t help. Always compare the cash price on the discount card to your insurance copay before choosing.

Can I use a manufacturer coupon with Medicare Part D?

Generally, no. Medicare Part D blocks most manufacturer coupons unless you get special approval. Even if you use one, the payment won’t count toward your deductible or out-of-pocket maximum. You’re better off using the plan’s negotiated price or a third-party discount card like GoodRx.

Why is the price different at every pharmacy?

Each pharmacy sets its own cash price for drugs. Discount cards negotiate different deals with each one. So a drug might cost $15 at Walmart, $22 at CVS, and $18 at Walgreens. That’s why you need to check multiple locations using an app like GoodRx before you go.

Are generic drugs always cheaper than brand-name ones?

Almost always - but not always. Sometimes, a brand-name drug has a manufacturer coupon that makes it cheaper than the generic. But this is rare. In most cases, the generic is the better deal. Always ask your doctor or pharmacist if a generic version is available and appropriate.

Can I use GoodRx and insurance together?

No. You can’t combine a GoodRx coupon with your insurance. You have to choose one or the other. The pharmacy will bill either your insurance or the discount card - not both. Always compare both prices before deciding which to use.

What’s the best way to find free medications?

Go to NeedyMeds.org. It’s a free, nonprofit site that lists Prescription Assistance Programs (PAPs) from drug companies and charities. You can search by drug name or condition. Most require proof of income and a doctor’s signature, but if you qualify, you can get your meds for free - no coupons needed.

Do these programs help with brand-name drugs like Lyrica or Humira?

They can help - but not as much as you think. For drugs like Lyrica or Humira, manufacturer coupons might reduce your cost from $600 to $500. That’s still a lot. Third-party cards like GoodRx often offer little to no savings on these drugs. Your best bet is to ask your doctor about alternatives, or apply for a PAP - those can sometimes give you the drug for free.

Are discount programs legal?

Yes, they’re legal. But there are rules. Manufacturer coupons can’t be used with Medicare Part D without approval. Some states are creating drug affordability boards that may limit how much pharmacies can charge - which could reduce the need for these programs. The FTC is also investigating whether some coupons unfairly drive up drug prices.

13 Comments

Write a comment