India pharmaceutical manufacturing: What you need to know about production, quality, and global impact

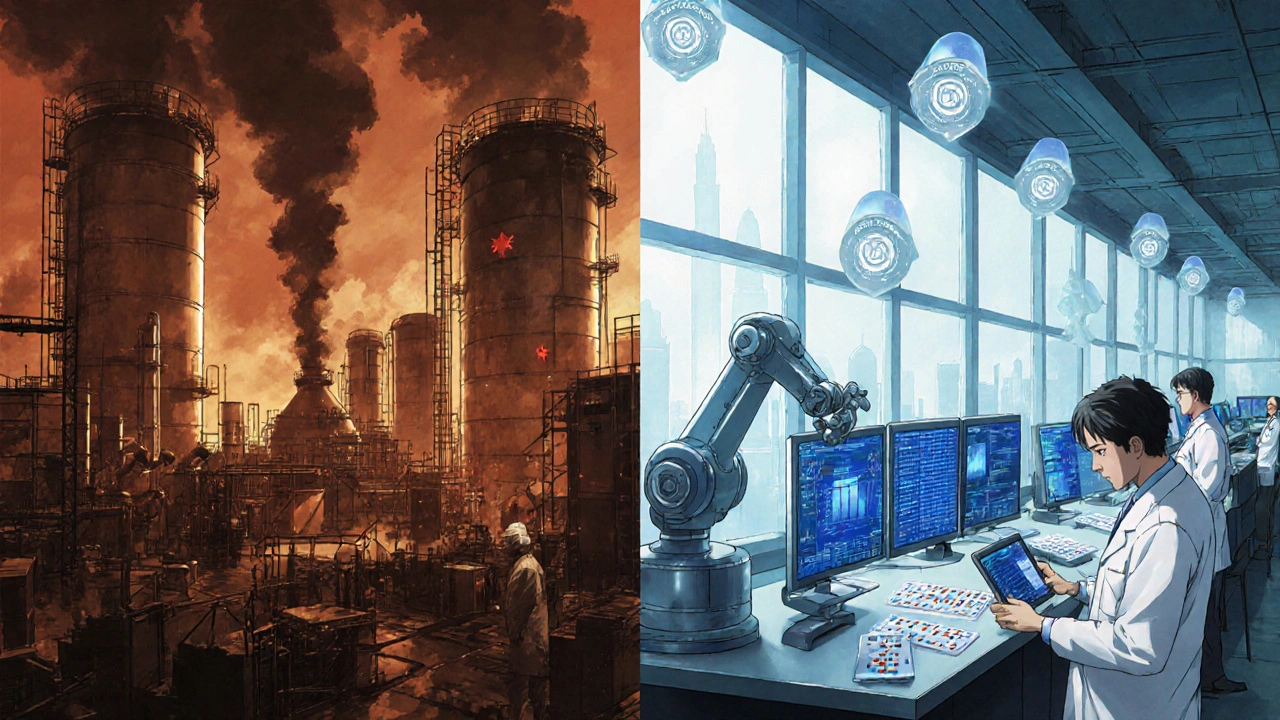

When you take a generic pill for high blood pressure, antibiotics, or diabetes, there’s a good chance it came from India pharmaceutical manufacturing, the world’s largest producer of generic medicines by volume. Also known as the pharmacy of the world, India supplies over 50% of global demand for generic drugs and 20% of all active pharmaceutical ingredients (APIs). This isn’t just about low cost—it’s about scale, precision, and a system built over decades to meet international standards while keeping prices affordable.

Behind every bottle of generic medicine you buy is a complex chain: raw materials sourced locally or imported, chemical synthesis in specialized plants, strict quality control labs, and packaging that meets FDA, WHO, or EMA guidelines. Companies like Dr. Reddy’s, Sun Pharma, and Cipla don’t just copy brand-name drugs—they reverse-engineer them, optimize formulations, and run clinical trials to prove safety and effectiveness. Many of these firms operate under the same rules as U.S. or European labs, with inspections, audits, and compliance checks that are just as rigorous.

But not all Indian manufacturers are the same. Some factories produce medicines for top global brands and pass every inspection. Others have been flagged for data integrity issues or poor sanitation. The generic drugs, low-cost versions of brand-name medications with the same active ingredients you get from a trusted pharmacy usually come from verified suppliers. That’s why countries like the U.S. and UK keep close tabs on Indian facilities—because when quality slips, people get sick. The API production, the process of making the active chemical ingredient in a drug is especially critical. A single error in synthesis can turn a life-saving medicine into a dangerous one.

What makes India’s system unique is how it balances affordability with volume. While Western drugmakers focus on innovation and patents, India’s strength is in making proven drugs at a fraction of the cost. This matters most for low-income countries, where a $100 monthly HIV treatment in the U.S. might cost $5 in India. But even in rich nations, these savings add up. Medicare and private insurers rely on Indian-made generics to keep costs down. And with more countries pushing for self-reliance in medicine supply chains, India’s role is only growing.

You’ll find posts here that dig into real-world examples: how a single batch of contaminated API can trigger global recalls, why some Indian drugs get approved faster than others, and how patients in Australia or the U.S. are using these same pills every day. There’s no hype here—just facts about who makes your meds, how they’re checked, and what you should know before you take them. Whether you’re a patient, a caregiver, or just curious about where your pills come from, this collection gives you the clear, no-fluff details you need.

China and India Manufacturing: Risks and FDA Monitoring in Pharma Supply Chains

China and India dominate global pharmaceutical manufacturing, but their risks and FDA oversight differ sharply. India leads in compliance and reliability, while China offers scale and cost - but with higher regulatory risk.